- Have any questions?

- Office: +1 (650) 345-8510

- Mobile: +1 (650) 576-6916

- norm@traveltechnology.com

Smartphone Market Share Influences Download versus Mobile Web Debate

Innovation in Online Travel

August 10, 2009Convergence

September 9, 2009In a recent article from Media Post a software application developer from Istanbul, Turkey attending a conference in San Jose, California, voiced his opinion that the US does not understand the importance of the Mobile Web. This article reminded me of the panel discussion I moderated at the PhoCusWright @ITB conference in Berlin earlier this year where the subject of downloadable applications was debated against the advantage of the Mobile Web with a panel of European mobile travel experts. During that discussion a common argument in favor of the Mobile Web approach was the ability to have the application available on all devices with a mobile Web browser. On the side of downloadable apps, the ability to use the GPS location capability and ability to balance the processing load between the network and device were common arguments for the downloadable app approach. Given the explosion of app stores from device manufactures and wireless network providers , it is clear that the downloadable approach has been recognized as an important channel for application delivery. So given this debate, what is the right approach for travel companies who want to build and deploy mobile apps?

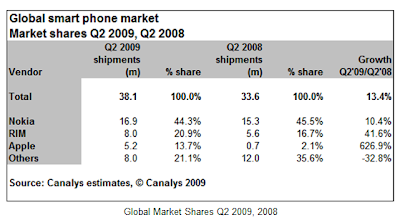

The answer lies in the recent 2nd quarter market share numbers published by Canalys. Here is the worldwide smartphone adoption numbers:

From a global perspective the growth of Apple’s iPhone is phenomenal. But the true insight comes from the individual regional market share.

Clearly in the US market RIM and Apple dominate the smartphone market.

Contrast this with the EMEA market share

Now compare this with the numbers for Asia Pacific:

As you see Apple and RIM do not even qualify for their own category and are grouped into Other.

The simple conclusion is this:

1) Clearly smartphones are a growing category.

2) Areas of the world dominated by Nokia have not felt the true impact of the smartphone adoption.

3) Travel companies need to understand the specific smartphone adoption market share percentages for their clients when planning a mobile strategy.

On a long term basis as recently voiced by Google, browser-based applications may dominant, but for the short term (3-5 years), downloadable apps will be the most logical path. Keep in mind that smartphone penetration is much greater for frequent travelers who are early adopters of smartphones. Developing applications for the leading smartphone devices: RIM, iPhone and perhaps Windows Mobile is the most logical path to follow. Nokia’s recent announcement concerning their new relationship with Microsoft is an obvious attempt by both companies to fight the growth of RIM and iPhone.