- Have any questions?

- Office: +1 (650) 345-8510

- Mobile: +1 (650) 576-6916

- norm@traveltechnology.com

Can Anyone Really Capture the SME Travel Market?

Who Pays for the Needed Upgrade to Travel Distribution?

July 24, 2020

Maybe What is Needed for Leisure and Corporate Travel to return is Local Human Support

August 19, 2020It was 1996 and I had just launched my consulting practice the prior September. On the agenda that day were consecutive calls with two startups, The Trip.com (not associated with the current iteration of the former C-Trip OTA) and BizTravel.com. Their mission was clear; to bring digitized travel management to the small/medium enterprise (SME) segment. And of course, the rest is history, these companies went on to become the dominant players in SME business travel space, right? Wrong, within the next few years both these companies would go out of business despite investment from industry heavyweights such as Rosenbluth International.

Fast forward to the early 2000’s and I found myself in the boardroom of Netscape, the leading Internet browser at the time. The purpose of the meeting was to discuss how Netscape could partner with Sabre BTS (this was prior to the GetThere acquisition) to create a SME portal where travel services would be part of a number of small business offerings. Suffice to say neither the SME portal idea nor in this case the actual company known as Netscape survived.

Over my 38 year career in the travel industry I have seen additional attempts at aggregating small business travel whether it was the Delta Airlines dedicated small business portal launched in the early 2000s only to be shut it down in 2002, or the more recently the acquisition of Hipmunk by SAP Concur again targeting the SME segment, which failed and was subsequently closed earlier this year.

News today that yet another acquisition has taken place where Online Booking Tool (OBT) startup, WhereTo, has been purchased by Flight Centre again with the goal to attack the SME segment. Why does Flight Centre expect to succeed in the SME segment with WhereTo especially given the fact that WhereTo was designed for large enterprise customers? A great deal depends on how it is executed.

Over the last four years the market has seen the emergence of well-funded new digital TMCs in the form of Trip Actions, TravelPerk, Travelbank, Lola and Uptake. There is clear evidence that these companies have gained some traction with smaller businesses. But where did this business come from and have these companies cracked the code to finally capture the SME opportunity?

The reality is that many of the companies that have signed on with these digital TMCs already had a managed travel program in place often with a smaller traditional TMC or in some cases one of the mega-TMCs. Though it is true that sometimes an account is brought on board to bring travel management to a previously unmanaged program, it is more likely the new client was captured from another existing TMC.

Any success in the SME segment should not be confused with market opportunity. There is a reason why prior attempts to consolidate SME business travel have never gained traction. By definition, many companies in this SME segment may chose not to implement formal travel policies. Some may believe that allowing the traveler to shop the best fare or rate represents the best way to control travel expenses. After all these companies generally do not have the volumes to negotiate significant supplier discounts.

In addition, the large mega-OTAs such as Expedia and Booking.com have successfully captured some of this business in their direct OTA channel or their dedicated business portals, such as Egencia or Booking.com for Business. The bottom line is that capturing SME market opportunity can be like the cliche “herding cats”, where the business is highly fragmented and there is a basic inability to get everyone within the SME or across SMEs to behave in a uniform fashion. The is also why TMC negotiations on behalf of multiple smaller companies or corporate buyers who form a buying consortium often don’t succeed due to an inability to deliver market share to maintain discounts.

The question is simple, is there a definable market for SME and if so how big is it and how easily is it captured? Even my colleagues at Phocuswright struggle with this segment as the unmanaged portion of the SME segment is lumped together with leisure travel rather than including the volume in their managed travel calculations. Though hard to measure most believe the SME market is substantial and thus a significant opportunity exists to capture this market.

Despite all these prior challenges, Covid-19 may actually help finally reach the SME segment. All business travel going forward will be highly scrutinized regardless of the size of the company. With corporate liability for Covid-19 related travel illness still unclear, no company, regardless of size, can afford to send their employees on the road without some sort of controls in place. In fact, the very need to keep up on the constantly changing travel restrictions by country and within a country, requires more information for travel planning than pre-pandemic behavior. Will these lead to more penetration of the SME market?

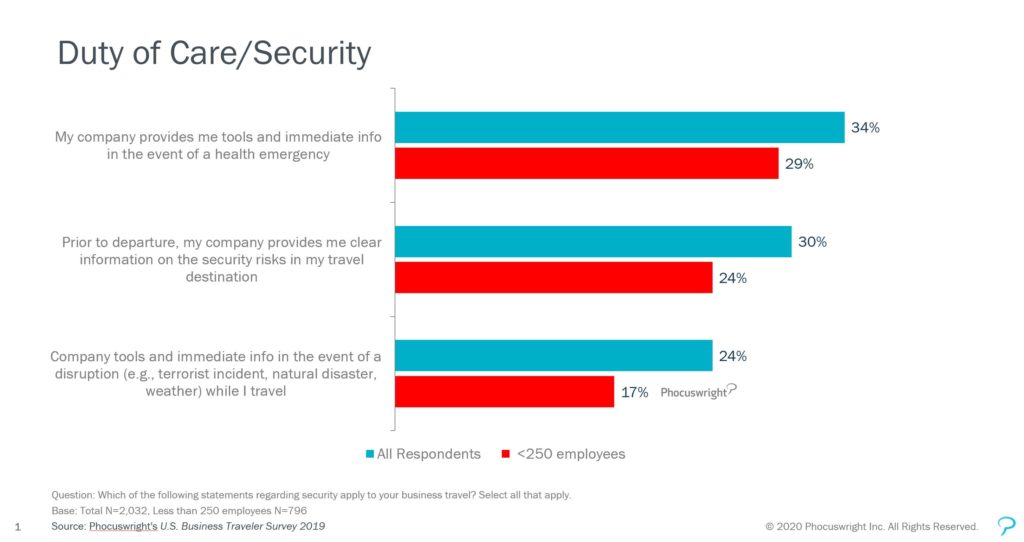

The answer lies with the SME traveler. Often at best, these companies have lightly managed travel policies. From traveler research I conducted on behalf of Phocuswright, unmanaged business travelers believe they are obtaining the best fares/rates for their companies. Of course, this was a pre-Covid-19 perspective. The 2019 Phocuswright Business Traveler Survey also documented a significant lack of support for health and safety communication on the lower end of the market.

If the promise of consolidating the SME part of the business travel market is ever going to materialize, the time may be now by providing this segment with proactive health and safety insight. It is important to note that this communication must be combined with a comprehensive selection of available fares and rates. Given the fragmentation that exists already, and which may increase with the further adoption of NDC, providing both proactive safety and security information combined with the best fares and rates may be the winning combination to achieve greater traction with the SME business travel segment.